Multi-book accounting allows users to enter source documents once and automatically create, track, and report on transactions in both cash- and accrual-basis accounting for a more accurate view of the business in real-time. The ability to automatically track multiple accounting methods provides greater efficiency without sacrificing accuracy. It allows businesses to analyze financial performance from multiple perspectives. It makes satisfying the different reporting requirements of both internal and external stakeholders easy thanks to enhanced visibility into both cash flow and overall business health. Accounting Seed, the #1 accounting solution built on the Salesforce Platform, recently unveiled its latest Multi-book Accounting offering.

“The beauty of this offering is the way transactions are tracked; Accounting Seed has eliminated the need to make manual adjustments,” said Ryan Sieve, Chief Technology Officer of Accounting Seed. “With Multi-book Accounting, transactions are automatically tracked in both cash- and accrual-basis. It gives businesses a real-time view into revenue recognition at the product level and the ability to run consolidations across both cash and accrual books. With the power to track KPIs across the business, organizations can confidently report to satisfy both GAAP and cash financial requirements.”

Key benefits of Multi-book Accounting

- Automated Tracking: Eliminate the need to record transactions in multiple places by having both accrual- and cash-based accounting tracked automatically in one system.

- Enhanced Visibility: Gain deeper insights into performance by viewing financials from different perspectives—empowering informed decision-making and strategic planning.

- Expanded Reporting Flexibility: Generate comprehensive reports tailored to meet the specific needs of regulatory bodies, internal management, and investors by effortlessly switching between accrual and cash-based methods.

- Improved Financial Controls: Easily reconcile differences between management and statutory reports while maintaining a clear audit trail for financial oversight.

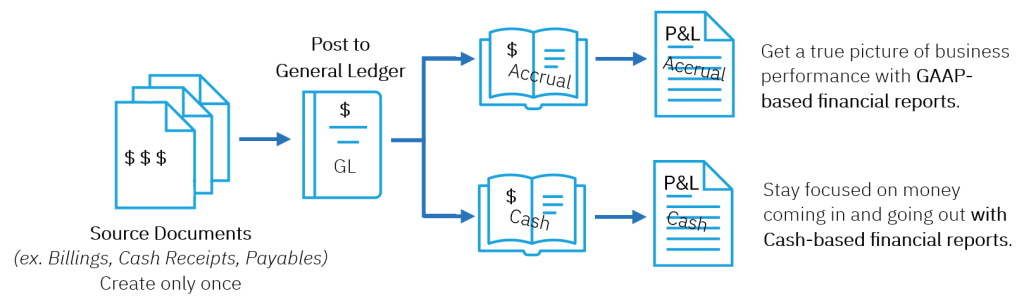

How does Multi-book Accounting work?

Enter source documents once for automatic creation, tracking, and reporting on transactions in both cash- and accrual-basis accounting.

Supported accounting methods

Cash vs accrual basis accounting

Whether it makes sense to track financial transactions under cash, accrual, or both depends on each business. In cash-basis accounting, income is generally recorded when customer payments are received, and expenses recorded when payments are made. While in accrual-basis accounting, income is generally recorded in the period in which it’s earned and expenses recorded in the period they are incurred—regardless of when payment is received or paid out.

Full spectrum financial reporting

The ability to automatically track in multiple accounting methods allows businesses to analyze financial performance from multiple perspectives all within Accounting Seed. It makes satisfying the different reporting requirements of both internal and external stakeholders easy thanks to enhanced visibility into both cash flow and overall business health.