Besides being the most formidable sales management and Customer Relationship Management (CRM) solution on the market, Salesforce has the ability to be equipped with native accounting software that works seamlessly with the rest of its IT environment.

Accounting on Salesforce saves you time, money, and stress, all while making your data-informed strategies more powerful and your processes more streamlined. Everything from lead to general ledger can be done in a matter of clicks in a single view.

How Does Accounting Work on the Salesforce Platform?

Salesforce can do accounting functions, but not alone. On its own, Salesforce is a CRM, which focuses on managing and tracking the sales process. While it does have add-on features like Salesforce Billing and Revenue Cloud, it’s not a dedicated accounting system.

Even with Salesforce, you still need to track transactions, account for the debits and credits in your business, and then compile and analyze this data to understand your financial health. You can’t do this with the Salesforce product alone, but that’s where other software comes into play. Salesforce can either work with outside technology or, even more effectively, connect with native software tools that are built on Salesforce itself. It is through native Salesforce accounting software that you can run accounting fully in your Salesforce instance.

What Does Financial Management on Salesforce Look Like?

You may be familiar with the urgency and stress associated with accounting. Maybe it’s why you’re looking for a better accounting app. If you’re on Salesforce, you have a significant opportunity to connect and streamline all your major applications to consolidate your data and operations onto a single platform. When you add accounting into the mix, the financial process behind your operations gets easier and more accurate. Let’s look at how.

CONNECTED, EFFICIENT DATA FLOW

Most, if not all, of your business tools, need to share data with your accounting system. Whether it’s processing a vendor payment, turning a quote into a bill, or recognizing a customer transaction started in another software, these tools must submit the transaction to the accounting system. The accounting software takes over to account for and tracks the finances that were generated. On Salesforce, this data-sharing can be instantaneous thanks to the connectivity between platform applications. Some of the most common connections start with Salesforce’s Sales Cloud and Service Cloud.

SMOOTHER, MORE HANDS-FREE ACCOUNTING LIFECYCLES

Salesforce on-platform accounting eliminates the need to monitor expenses or track billing in a separate system or spreadsheet. On Salesforce, you can click a button in one app and the accounting will take over when it’s needed. It’s as easy as initiating a bill in Salesforce and then having that data show up in your general ledger for processing and recognition. Additionally, automations can be more refined and effective because all of your solutions are in one place. This allows your accounting lifecycle to be more efficient and visible because the relevant data is connected to your accounting system, uninterrupted.

MORE ACCURATE ACCOUNTING WITH LESS HASSLE AND EXPENSES

The lack of interruptions or having to manually input data also eliminates accounting errors while giving you fast answers and accounting processes like monthly close. This also saves you more money!

However, the level of technical efficiency and accounting benefits really depend on the type of software you’re using. Just because an accounting app can work with Salesforce, does not make it a native Salesforce accounting software solution.

Accounting Software and Salesforce

While Salesforce can work with just about any type of solution through custom integration, there are those better suited than others. This is particularly true with accounting technology. Recall that data generated from other business tools needs to be shared with the accounting system. This means that a reliable IT connection is essential.

Traditional, custom integration is used to connect unrelated software, but this isn’t the case for Salesforce-based solutions. There are two types of software to choose from based on how they can work with Salesforce.

NATIVE SALESFORCE ACCOUNTING SOFTWARE

Native accounting products are built using the Salesforce IT architecture. Some of these products are also considered Enterprise Resource Planning (ERP) solutions. This is because we’re built with the same Application Programming Interface (API) as Salesforce. Besides inheriting core platform features, the Open API lets native solutions connect with other on-platform applications without a new integration being created. These solutions are designed to work together on Salesforce.

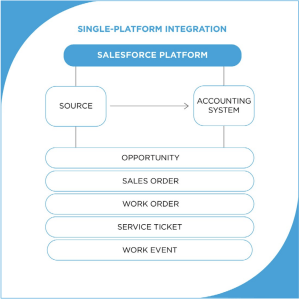

The connectivity between these native apps is highly stable and reliable because it is a simple stream of data sharing. This means that technical issues are very minimal, if not non-existent. You can see how this ‘single-platform’ integration works here:

You’ll note that all the data is stored on Salesforce. When events are triggered or started in various apps, for example, a service ticket is issued, the data that reflects an accounting action is simply sent to the accounting system. From here, the transaction is logged in the general ledger and financial management begins. Everything is done on Salesforce, which means, technically, this isn’t an integration.

Besides the relative data being easily consolidated into the accounting system, this gives users many far-reaching benefits.

If you’re on Salesforce, native accounting software is your best, most cost-effective option. Otherwise, you’re looking at integrating to a solution outside the Platform. This presents several challenges.

Native Salesforce Accounting vs Outside Accounting Apps

So, if you’re on Salesforce and you need accounting, the choice is whether to use outside accounting tech and deal with integrations or go native. The reality is that native accounting technology lets you avoid all the costs of integration while also giving more reliable and flexible financial management.

Even if you’re using popular accounting software with a well-constructed integration, you’ll still face data risks and maintenance issues. And of course, integration maintenance will go on throughout the system’s life cycle. This is not the case for native software.

Working with Salesforce accounting apps is easier, more affordable, and more streamlined. Because the layout and platform features are inherited from Salesforce itself, you can expect a smooth adoption and seamless accounting across all your organization. But more importantly, it’s sustainable. This is because native solutions are just as configurable and customizable as the platform itself. But if that’s not enough, here are some additional benefits.

Additional Native Salesforce Accounting Benefits

INHERITED PLATFORM FEATURES

All native solutions have shared Salesforce Platform features. These make it easier for users to track activities and monitor accounting lifecycles. Coordinate workflows and activities throughout Salesforce and your accounting system through features like Slack, Import Tools, and more.

AUTOMATION

Salesforce is an automation powerhouse, and so are its accounting apps. Automate billing, and reports, and generate configurable Salesforce dashboards with a button click. You can automate the entire financial journey from lead to ledger.

FLEXIBILITY AND OPTIONS

Native Salesforce accounting solutions can be fully tailored to suit unique reporting and processes relative to your individual reporting needs. Instead of having to conform your accounting processes to the software, the software adapts to you. Native applications come equipped with customization and configuration tools for easy use. This makes your financial management more streamlined and effective.

Additionally, native accounting solutions work with all other native tools without integration. This means you have access to hundreds of native applications from the Salesforce AppExchange you can use without additional costs or time on implementation.

SEAMLESS VISIBILITY AND COLLABORATION

Collaboration and the visualization of data within the accounting system is key. Teams must access, share, discuss, and validate accounting data together. Because native accounting is Salesforce-based, staff will be able to use relevant tools and processes to stay on top of all critical data.

HIGH-LEVEL SECURITY

Native Salesforce accounting tools are fully equipped with robust IT security. Besides inheriting the highly reliable and secure Salesforce infrastructure, users can access high-level data security features right out of the box. Platform-based internal control and permissions features protect you from both internal and external threats. These also make managing compliance a lot easier.

Here are some of the native features:

• Secure API

• Two-factor authentication

• User permissions

• Real-time event monitoring

• And more!

FASTER, EASIER IMPLEMENTATION

Integrating to an outside solution isn’t just costly, it can also take a lot of time to implement. This is not the case for native Salesforce accounting software. Remember, they are pre-designed to function on Salesforce and with related tools. For example, Salesforce customers can adopt and implement an accounting app in a fraction of the time it takes to integrate to outside products. Additionally, native accounting apps work seamlessly with Salesforce extensions and packages.

Besides helping you use and access the technology faster; this also helps save you money directly. Additionally, staff will be able to pick up the software faster because the interface is the same as other native tools already being used.

For more insight on the benefits of native Salesforce accounting technology, contact us…We’re happy to help!